Global Investment Solutions

Global Investment Solutions

-

01

- Inside the Platform 02

- Margin 03

- Mobile Trading 04

- Open an Account 05

- Trading 06

- Frequently Asked Questions

Inside the Platform

Accounts

The Accounts tab enables you to view details about your accounts. As you click through the sub-tabs you can obtain information such as account balances, holdings, history, projected cash and asset allocation.

Summary

Access a high level overview of your portfolio—clearly displaying market valuation by account, an asset allocation pie chart, the five most recent trade executions and orders, and the 10 largest holdings by market value.

Holdings

Retrieve details on the holdings within any of your accounts, such as intraday data by security type, and realized and unrealized gains and losses.

History

Review up to two years of account transaction history for your accounts. You can search by transaction type and stock symbol, and specify a time period or a specific date range to narrow your search.

Statements and Trade Confirmations

View up to 10 years of account statements, and 3 years of trade confirmations. Be sure to enroll for paperless statements and trade confirmations by clicking the “Go Paperless” link at the top of the screen.

Trading

NetExchange Client enables you to enter equity, option and mutual fund orders online, seven days a week, providing you with the flexibility of investing when it is most convenient for you. By clicking on the Trading tab, you will have the ability to place trades and view your order status. You will also be able to view the funds you have available to trade on the order ticket and the estimated transaction value on the order review page.

Markets

NetExchange Client makes it easy to keep abreast of the latest market conditions on the Markets tab—track market movers, access market headlines and more. You can stay informed using the Market Highlights page— get current information on major U.S. market indices, including Advancers and Decliners. The Winners and Losers sub-tab displays most actives, percentage winners, percentage losers, dollar winners and dollar losers by the exchange. Other sub-tabs within the Markets tab include Top News, which provides news stories by topics, such as energy, healthcare and technology, and Rateboard for easy access to current money fund rates, interest rates, stock and option indices, commodities and currency rates.

Quotes and News

Get quotes for stocks, options or mutual funds. Obtain the latest news headlines for each stock, as well as detailed information—including last bid, ask and volume numbers. You can also view charts for each security—which display intraday quotes to up-to-10 years of performance history. You will have access to Standard & Poor’s® Snapshot reports, Annual Reports and SEC Filings for the company you are researching, and you can put your research to work by creating Watchlists of securities to track quotes and performance.

Security Features

To ensure your information is completely protected, important security measures are in place. Upon log on, you will be prompted to enter your user ID and password on separate pages, as well as to set up a variety of security challenge questions designed to verify your identity should you choose to log on from an unrecognized computer. As an additional security measure, you will select an image and phrase that will display each time you log on to confirm that you are on an authentic NetExchange Client website.

Get Connected to NetExchange Client

The ability to have online access to your investments is critical in today’s fast-paced environment. NetExchange Client makes this possible by providing the tools you need to conveniently monitor and manage your investments in a secure, user-friendly environment.

System requirements

Browser: Microsoft Internet Explorer® 7.0 or later, recommended: 8

Internet Connectivity: Internet access capabilities

Margin

What is a Margin Account?

A Margin Account allows you to:

- Borrow funds while using the marginable securities you have in your account as collateral.

- You can purchase additional securities without paying for them in full. When using margin to purchase securities, a portion of the cost (usually 50%) is deposited, while the rest is loaned to you.

What are the advantages of having a Margin Account?

- It provides you with access to funds at interest rates that may be lower than standard bank or credit card loans.

- No lengthy approval process—all you need is a signed Margin Agreement along with sufficient marginable securities in your account, and the cash is yours.

- You can use your security as collateral and still benefit from capital gains, dividends or interest payments.

- No established repayment term. Your loan can remain outstanding for as long as you wish once the value of the securities used as collateral does not fall below the required minimum level.

- Increased purchasing power of securities transactions

- Short selling for potential profits.

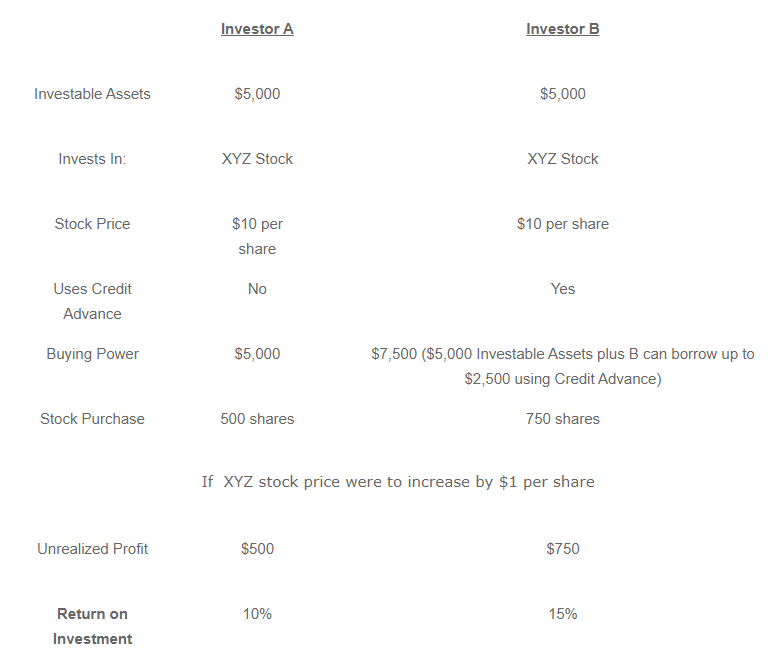

How does Margin Work?

What are the Risks involved?

While Margin Trading does increase the potential for profit, it also increases the potential for loss.

In a cash account, your risk is limited to the amount of money that you invested. In a margin account, your risk includes the amount of money you have invested plus the amount that has been loaned to you.

How do you reduce the risks associated with Margin?

- Borrow less than the full loan value of your securities. You still enjoy the benefits of leveraged buying power and low cost borrowing. This way, you pay off more of your purchase and lessen the chances of your account falling below required margin levels during market fluctuations.

- Maintain a diversified portfolio. A mix of conservative investments can lessen, but not eliminate, the risk of loss.

Borrowing on margin is not for everyone and careful consideration of your personal investment objectives, your financial situation, and your tolerance for risk must occur. You can contact one of our Advisors for more information on this facility and the procedure for accessing it.

Mobile Trading

In today’s fast-paced world, clients need convenient access to their account information. NetExchange Client Mobile®, now available on iPhone®, iPad®, Blackberry and Android devices provide clients with anytime-anywhere access to critical account information and market data. With many of the same features as the desktop application, NetExchange Client Mobile on iPhone allows clients to trade, check balances, positions, quotes and market indices.

Getting started is easy

Clients who already use the desktop application will be able to login to NetExchange Client Mobile with the same user ID and password that they use on the NetExchange Client website, and will not incur any additional charges.

To begin using the mobile application, all you have to do is follow the basic instructions on the NetExchange Client website. The Mobile Splash Page and a banner on the right-hand module of the Balances, Holdings, Account Summary, Market Highlights pages link users to this information.

Security

Industry best practices have been employed to ensure a safe environment for our client’s data. NetExchange Client Mobile uses the same SSL/HTTPS technology that is used for the NetExchange Client website.

Open an Account

We are pleased to provide you with the following instructions for opening a Global Investment Solutions account with First Citizens Investment Services. The enclosed forms are provided for your convenience. After completing the forms, kindly visit any of our offices to have your account set-up:

Branch Locations:

- 46 Lady Hailes Avenue, San Fernando, Trinidad and Tobago. Telephone: 1-868-657-2662

- 17 Wainwright Street, St. Clair, Trinidad and Tobago. Telephone: 1-868-622-3247

Download and fill out the forms below:

Trading

Start trading today!

- Invest with Guidance: Discuss your options with one of our qualified Advisors for Market updates and sentiment. We will then execute trade requests on your behalf and take responsibility for timely and accurate execution.

- Invest on Your Own: You have the power to take your trading activities into your own hands. You will be responsible and fully in control of all order executions at your convenience.

To begin trading, please contact one of our Advisors at 622-3247; 657-2662 or e-mail us at wealth@firstcitizenstt.com

Frequently Asked Questions

Can I trade on stock exchanges outside of the US?

Yes. Call your Wealth Management Professional to find out how.

Is options trading available?

Yes, we recommend this only to clients with extensive trading experience.

Are structured products available?

Yes. Please liaise with your Wealth Management Professional.

Can I place trades outside of normal market trading hours?

Yes, just inform your Wealth Management Professional after the trade is placed.

Can I withdraw my gains?

Yes, you can, simply make the request through your Wealth Management Professional and your funds will be wired to you.

Can I do margin trading?

Yes, we recommend it for clients with extensive trading experience.