- Credit Limit starting from TT$10,000

Credit Card FAQs

General Credit Card FAQs

What are the requirements for a Credit Card?

Credit Card Application Checklist

Scan and upload the following documents via the Online Credit Card Application Portal

- Salary slip, not more than 1 month old

- Two (2) forms of valid identification

- Proof of Address not older than 3 months* (bank statements can be provided as a proof of address)

- Job Letter addressed to First Citizens not older than 3 months old

- Politically Exposed Persons (P.E.P) Declaration for Individual Form – This is your declaration on if you are a Politically Exposed Person (PEP), which the Bank needs to know, in line with the Proceeds of Crime Act 2000 (as amended) and the Financial Obligations (Amendment) Regulations 2014, Regulations 20(3). Definitions on who qualifies as a PEP is provided on the form

- Customer Declaration – This form provides the Bank with the customer’s declaration on if he/she has any tax obligations in any jurisdiction outside of Trinidad and Trinidad. This is in line with the Tax Information Exchange Agreements (United States of America) Act 2017

- Credit Card Standing Order Form – This form allows you to easily make arrangements so that your credit card payments are automatically kept up to date via standing order options which suits you.

- Note: *If the proof of address e.g. utility bill, is not in your name, a letter of authorization from the person in whose name the bill is in should be provided, along with a copy of a valid ID of the said individual.

- ** Co-applicants must be a minimum 16 years and one form of valid identification is required

For any questions, please contact us via any of the options below:

- Chat with us via WebChat

- Email us at: cardsales@firstcitizenstt.com

How can I obtain my Credit Card statement balance due?

You can obtain your Credit Card statement balance due via:

- Monthly Credit Card statement

- Online Banking

- Telebanking

- Mobile App

How can I obtain my real time Credit Card available balance?

You can obtain your real time available balance via Online Banking, the Mobile App or the ATM

What is my Credit Card statement date and when is my payment due?

Please refer to Table I below:

Table I

| Card Type | Statement Date | Payment Due Date | Minimum Balance Calculation |

| Visa Tertiary | 10th monthly | 30th of the same month | 1/24 of the outstanding balance as at the statement date |

| Visa Classic | 13th monthly | 2nd of the following month | 1/24 of the outstanding balance as at the statement date |

| Visa Purple | 13th monthly | 2nd of the following month | 1/24 of the outstanding balance as at the statement date |

| Visa 2 In 1 | 13th monthly | 2nd of the following month | Full Payment: total balance as at the statement date Minimum Payment: loan installment plus 1/24 of the outstanding balance as at the statement date |

| Vacation Lifestyle Mastercard | 13th monthly | 2nd of the following month | 1/25 of the outstanding balance as at the statement date |

| Vacation Lifestyle MasterCard Gold | 16th monthly | 5th of the following month | 1/30 of the outstanding balance as at the statement date |

| Visa Gold, Platinum Signature and Infinite | 16th monthly | 5th of the following month | 1/30 of the outstanding balance as at the statement date |

How can I make a Credit Card payment?

You can make a Credit Card payment via:

- Online Banking

- Telebanking

- Mobile Banking App

- ATM

- Fast Deposit Boxes located in any conveniently located First Citizens Branch

- A Standing Order from your First Citizens account or another Bank’s account

How soon do I have access to funds paid to my Credit Card?

You will have immediate access to funds on your Credit Card, once transferred from your First Citizens account to your Credit Card via First Citizens Online Banking, the Mobile App or Telebanking.

Please note:

- Payments made on Monday – Thursday by 3:00 pm or Friday by 4:15 pm are updated the same night

- Payments made on Fridays after 4:15 pm, will be credited to your Credit Card on Monday night

- Payments made on public holidays will be credited the night of the next business day

What Credit Card Reward programmes are offered?

There are two main Credit Card Reward programmes currently offered:

Is there insurance coverage with my Credit Card?

International Emergency Medical Services and World Wide Auto Rental Insurance are offered to Visa Platinum, Signature and Infinite Credit Cardholders.

Please click here for further information

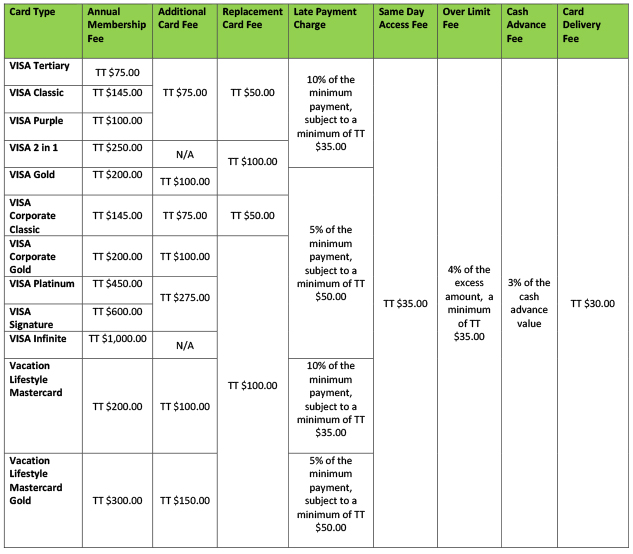

What are the fees and charges associated with my First Citizens Credit Card?

Please refer to Table II for the fees and charges associated with your First Citizens Credit Card:

Table II

When my Credit Card expires, how will I receive my renewed card?

Your renewed Credit Card will be directly delivered to you via TTPOST Couriers (TrackPak) to your mailing address currently on record at First Citizens. Please note, a delivery cost of TT $30.00 will be charged to your Credit Card.

What is the Foreign Currency Limit on my Credit Card?

The Foreign Limit varies for each card type, please refer to Table III for further information.

Table III

| Credit Card | USD Limit |

| Visa Tertiary | $2,000 |

| Visa 2 in 1 | $2,000 |

| Visa Purple | $2,000 |

| Visa Classic | $5,000 |

| Visa Business Classic | $5,000 |

| Vacation Lifestyle Mastercard | $6,000 |

| Vacation Lifestyle Mastercard Gold | $6,000 |

| Visa Business Gold | $6,000 |

| Visa Signature | $7,000 |

| Visa Gold | $7,500 |

| Visa Platinum | $7,500 |

| Visa Infinite | $8,000 |

How do I set a Standing Order payment to my Credit Card account?

You can log in to Online Banking:

- Click the “Payments” main tab and select “Standard Payee Payments” or

- Send a Secure Message by clicking the “My Messages” main tab and select “Send New Message” requesting a deduction of the minimum or full outstanding balance from your personal account on a specific date (the 28th is recommended).

You can also visit any conveniently located First Citizens Branch and a

Customer Service Representative will assist you.

How do I request a replacement card and/or PIN?

You can request a replacement card or PIN by logging in to Online Banking, click the “My Services” main tab, then select “Credit Card/ PIN Replacement”. Your card will be delivered within seven (7) business days and your PIN will be sent to a First Citizens Branch of your choice for collection. Please note, a delivery cost of TT $30.00 will be charged to your Credit Card.

For customers residing abroad, you can request a replacement card and/or PIN to be delivered by FedEx via Online Banking.

What should I do if my Credit Card is lost or stolen?

You are required to immediately call 62-FIRST (623-4778) to make a report and a new Credit Card will be issued and delivered to your local mailing address. Our Contact Centre is available every day from 6am to 10pm.

If you are abroad, call:

- VISA at 1-800-396-9665 when in the U.S.A /Canada, or in other countries, call 1-303-967-1098

- Mastercard at 1-800-307-7309 when in U.S.A /Canada, or in other countries, call or 1-636-722-7111

First Citizens Credit Cards with Chip and PIN Technology FAQs

What is a Chip and PIN credit card?

A credit card with Chip and PIN technology contains an encrypted embedded microchip, which stores data more securely and strongly reduces the possibility of fraud. The security of this technology automatically creates an enhanced customer experience.

What are the benefits of Chip and PIN credit cards?

- Guaranteed international acceptance at merchants including those in the UK and Europe.

- Increased protection against lost, stolen or counterfeit card fraud through the ability of the chip to securely store and process data.

- Additional layer of security when Chip and PIN credit card is used at a Chip and PIN point of sale terminal/merchant. In this scenario, the customer is required to input his/her PIN, which he/she alone should know.

Will my First Citizens Credit Card no longer have a magnetic stripe then?

Your First Citizens Credit Card will carry both Chip and PIN technology plus the magnetic stripe technology, so that your card will be accepted in essence at all point of sale machines and ATMs worldwide.

Does this mean that the magnetic stripe technology, which is currently on the back of my First Citizens credit card, is not secure?

The magnetic stripe technology is and continues to be very secure. The Chip and PIN technology simply moves to make an already very safe payment system even more secure.

First Citizens, as part of its core credit card operations, currently protects and will continue to diligently protect our cardholders from fraud via our 24/7 credit card monitoring service, whether the card carries magnetic stripe technology only or if it carries magnetic stripe technology plus the Chip and PIN technology.

Can a First Citizens Credit Card with Chip and PIN technology be compromised?

The Chip and PIN technology is the new technology in the payments world, mandated by the international payments associations VISA and MasterCard International. To date, in line with the benefits of the technology, we are not aware of situations where credit cards with the Chip and PIN technology have been compromised. If that unlikely scenario occurs, then the situation will be handled in line with the rules as prescribed by VISA and MasterCard International.

How will my First Citizens Chip and PIN Credit Card work?

Your First Citizens Chip and PIN Credit Card allows you to do everything you currently do with your credit card; i.e. local, international and online purchases and cash withdrawals.

The difference that the Chip and PIN technology brings is in how your credit card transaction is processed.

The processing of a purchase transaction depends on whether the merchant’s point of sale machine is chip enabled or non chip enabled. In Trinidad and Tobago and internationally, there are merchants with chip enabled machines and merchants with non chip enabled point of sale machines. Similarly, there are also chip enabled and non chip enabled ATM machines.

The process for online transactions is unchanged. However attention is to be paid to the expiry date which you may agree to store on the sites where you regularly shop.

Will all merchants eventually process credit card transactions on Chip Enabled point of sale machines?

Eventually all merchants worldwide will be using Chip Enabled point of sale machines. Currently the technology is more dominant in Europe but is on the way to becoming the accepted technology worldwide, as this is the mandate of both VISA and MasterCard International.

To ensure a smooth customer experience, Banks which issue credit cards, including First Citizens, will offer credit cards with both magnetic stripe and Chip and PIN technology, so that customers can pay at both Chip Enabled and Non Chip Enabled point of sale machines.

How will my First Citizens Chip and PIN Credit Card work at a chip enabled point of sale or ATM machine?

When doing a purchase at a merchant with a chip-enabled Point of Sale machines, the cardholder is required to enter his/her PIN to verify the transaction, similar to how a Debit Card transaction is done. The system validates the data on the Chip and the PIN, resulting in a more secure transaction.

There is no requirement for the customer’s signature in this scenario. When the transaction is complete, the merchant will be prompted to remove the card, will receive the sales slip and will provide the customer with his/her copy.

Please note that the card is inserted in the point of sale machine at the start of the transaction and left there for the duration of the transaction. Removal of the card during the transaction will terminate the transaction.

Withdrawals at chip enabled ATMs require the input of the PIN, as is customary.

How will my First Citizens Chip and PIN Credit Card work at a non-chip enabled point of sale or ATM machine?

A purchase at a merchant with a non chip enabled point of sale machine will be processed using the swipe and sign process i.e. the card is swiped and the customer signs the receipt, which is the norm for credit card purchase transactions in Barbados at this time.

Withdrawals at non chip enabled ATM require the input of the PIN, as is customary.

Am I still required to sign at the back of the First Citizens Credit Card with Chip and PIN technology?

Yes. Even though we refer to the credit card as the “First Citizens Credit Card with Chip and PIN technology” please note that the card also carries the magnetic stripe technology.

The magnetic stripe technology allows the cardholder to do a purchase transaction at a merchant whose point of sale machine is not chip enabled. In this scenario, the cardholder will be required to sign the sales receipt and so his signature on the sales receipt will be compared to the signature on (i) the back of the credit card as well as (ii) the form of picture identification presented.

What is the importance of my PIN with my First Citizens Chip and PIN Credit Card?

Your PIN is required to process purchase transactions at chip enabled point of sale machines as well as for cash withdrawals at chip and non chip enabled ATMs.

Therefore your PIN has now become even a more central security element for your purchase transactions, similar to how you process Debit Card transactions. Whilst a sizeable number of point of sale machines in Barbados may be non chip enabled, it is strongly recommended that you remember your PIN, as you never know when you will interact with a chip enabled point of sale machine, either locally or internationally.

Your First Citizens Chip and PIN Credit Card will be blocked after three (3) inaccurate PIN attempts.

What are the additional fees on the First Citizens Chip and PIN Credit Card?

There are no additional fees. All fees remain unchanged.

Is the Chip and PIN technology available for my Debit card as well?

Chip & PIn technology is also available with the Debit Cards

First Citizens Rewards FAQs

What is First Citizens Rewards?

First Citizens Rewards is the evolution of the My Rewards program. First Citizens Rewards gives you the power to redeem rewards on all your everyday spending online, in-App and in-store. Anywhere, anytime.

Once you sign up on the App, you will instantly access your new First Citizens Rewards Card. Simply add your First Citizens Rewards Card to any virtual store e.g. Apple Pay, G-Pay, Samsung Pay, Visa SRC, Amazon Pay or PayPal — access them on your phone inside the First Citizens Rewards App or via wearables. Even via Alexa or Siri. You can also use it on any e-commerce site around the world. Globally or locally.

Redeem your earned miles on the First Citizens Rewards App or at 70+ million stores around the world, both online and on-the-go by adding your First Citizens Rewards Card to your preferred e-wallet. If you do not have sufficient miles for the desired purchase, use your credit card to pay for the difference.

Plus you will continue to access all the travel content from the Expedia Group and all the benefits like Best Price Guarantee, No fees for rebooking and purchase protection. It gives more power to your wallet, and a new way to combine multiple global currencies and rewards with any card you want to use.

Do my miles expire?

Yes. Miles expire four (4) years after it is earned.

How to log in to the First Citizens Rewards App and activate my account?

Existing user To activate your account, follow these simple steps:

- Download the new First Citizens Rewards App available for iOS and Android

- Enter your email address (the one provided to First Citizens)

- Enter your password (same password created for My Rewards)

- Accept the Terms & Conditions

- Get your new First Citizens Rewards Digital Card

It’s that easy! You are now ready to start redeeming. Just add your First Citizens Rewards Card to your e-wallet or use it upon check-out and start shopping with your miles!!!

***user already registered in My Rewards will have to use the same credentials***

How to sign-up on the First Citizens Rewards App?

New user To activate your account, follow these simple steps:

1. Download your new First Citizens Rewards App available for iOS and Android

2. Enter your email address (the one provided to First Citizens)

3. Confirm email adresss

4. Complete user info

5. Set up a password

6. Accept theTerms & Conditions

7. Get your First Citizens Rewards Digital CardIt’s that easy! You are now ready to start redeeming. Just add your First Citizens Rewards Card to your e-wallet or use it upon check-out and start shopping with your miles!!! Remember you can also go to “My Account” and complete your Smart Profile, with your most frequent payments and purchases, travel preferences and/or access your miles balance.

How to sign in to the First Citizens Rewards Web?

Click sign-in on the top right of the website, enter your email address associated with your Bank, create a password, accept the Terms & Conditions and you are now ready to start redeeming.

Already registered? You are all set; sign in with the same credentials you currently use for My Rewards and start redeeming your way!

How do I reset my password?

No need to worry! At log-in, select “reset password” and you will receive an email with the necessary information you need to reset it.

How do I earn Rewards?

You earn rewards: 1 mile for every TT$8.50 spent on all purchases, both locally, internationally & online.

How can I spend my miles?

Instantly use your miles anywhere, online or in-store at 46+ million locations around the world. Simply add your First Citizens Rewards Card upon check-out or add it to your favourite e-wallet e.g. Apple pay, Microsoft Wallet, Samsung Pay. You can also pay contactless or by talking to Alexa or Siri.

Use your First Citizens Rewards Card: Add it to your e-wallet or use it upon check-out at your favourite stores to redeem miles for your purchases.

Pay with miles towards your purchases or redeem in-App for your next vacation or staycation. Access the best deals from Expedia Group, plus additional benefits: Best Price Guarantee, Purchase Protection and No fees for rebooking.

What are the benefits of the “First Citizens Rewards” Programme?

Enjoy 24-hour access via the First Citizens Rewards website or App to:

- View and redeem your miles

- Make flight and hotel reservations

- Book vacation activities/ tours

- Make online bill payments

- Pay for subscriptions e.g. Netflix, Spotify, and Amazon Prime

- Shop at 46+ million online, in-App and in-store

Would all First Citizens Rewards Customers receive 2 cards – the Physical and Virtual Card?

No

All Customers: Your virtual card is instantly issued when you complete your activation in App/Web and can be used to redeem online or in-store, once added to your favourite e-wallet e.g. Apple pay, Microsoft Wallet, Samsung Pay.

Qualifying* Customers: Once notified* with Existing physical rewards cardholders: The physical card is the perfect complement for use to redeem in-store to maximize YOUR miles YOUR way!!

For security purposes, the Physical Card must be activated.

In the event that your physical rewards card has been replaced, a new digital card will also be issued; therefore you will be required to update your payment information accordingly on any previously used websites.

How do I activate my First Citizens Rewards Physical Card?

It’s easy! Log in on the First Citizens Rewards App, go to My Account and tap Activate First Citizens Rewards Physical card.

WhatsApp will be prompted so that you can enter the last 4 digits of your card.

You are all set! You are now ready to redeem anywhere you go!

Can I use the First Citizens Rewards Card for travel bookings?

Absolutely! You still have access to the exclusive Expedia travel content. Millions of travel options around the world at unrivalled prices.

Book your way with no seat restrictions, no blackout dates, no limits.

Always protected — the “flex way”.

Unique and flexible fares with no extra charges for cancellations or rebooking delayed or missing flights and baggage.

Protection for lost or damaged personal travel devices.

Best-price guarantee & much more.

How do I use my miles in virtual stores?

Simply add your First Citizens Rewards Card to any virtual store e.g. Apple Pay, G-Pay, Samsung Pay, Visa SRC, Amazon Pay or PayPal, and use it on any e-commerce site around the world. Globally or locally. Add your First Citizens Rewards Digital or Physical card upon check-out.

How can I redeem my miles for travel? (App)

To redeem your miles within the First Citizens Rewards App:

- On the home screen, on the top left corner, locate and click on the airplane icon.

- Select among flights, hotels, car rentals, and activities.

- Enter the information of the passenger(s).

- Click on pay and enter your card´s information.

- Slide the icon to the right or left and choose the combination of money and miles to make your payment.

- Lastly, click on ¨Yes. Confirmed¨, and you´re ready! You´ve made your reservation successfully!

How can I redeem my miles for travel? (Web)

It´s easy! Download the First Citizens Rewards App at Google Play or App Store. Once you log in, choose between “Book flight, Book hotels, Book car rental or Book activity¨. After you have selected the option of your preference, click the magnifying glass and you´ll be able to see the price of your reservation in USD and miles. Choose the one that works best for you. Click ¨confirm information¨, accept Terms and Conditions, and lastly, tap on “Pay now”. At the bar, you´ll choose the amount you´re going to pay in USD and miles.

How can I see my transactions and track my miles spend?

To keep track of your spending, select “My Account” then “My transactions”. This allows you to see the number of miles spent and the equivalent dollar value, each time your First Citizens Rewards card is used.

What is the billing address for when I am using the First Citizens Rewards Card?

Use the same billing address that you currently use with your Bank.

I had a declined transaction, why is that? When using your First Citizens Rewards Card, double-check to ensure that you have enough miles in your rewards balance to complete the purchase. You can verify your balance on the top-right screen of the First Citizens Rewards App or website.

If you are using the First Citizens Rewards Card for an e-commerce transaction, be sure to enter all the requested card information including the expiration date and the 3-digit code on the back of the card.

How do I calculate the number of miles a purchase will utilize?

Each Mile is valued at US$0.015. For example, you may calculate the miles utilized using the following formula: US$100/0.015 = 6,666 Miles. Transactions may be subject to universal (Point of Sale/eCommerce) fees upon redemption, therefore the actual Miles charged may vary.

I don’t see my miles balance in the App?

To view your miles in the First Citizens Rewards App: Go to the Main Menu, then “My account”. Click “My balance” and select the date you would like to see; your miles will be displayed.

I don’t see my miles balance on the Website?

To view your miles on the First Citizens Rewards Website: Go to “My balance” and select the date you would like to see; your miles will be displayed.

Is the First Citizens Rewards Card a credit, debit or prepaid card?

First Citizens Rewards Card is not a credit card, a debit or a prepaid card. It is a hybrid card that gives you the power to spend anywhere and the freedom to combine credit cards and rewards of any kind to complete transactions.

Are there any fees attached to the First Citizens Rewards Card?

There are no fees or annual charges attached to the Card.

How do I add My First Citizens Rewards Card to Apple Pay?

To obtain the data of your First Citizens Rewards Digital Card and register it in the virtual wallet of your iPhone, iPad, Apple Watch or Mac., follow these 3 simple steps:

1. On the main screen of your First Citizens Rewards App, select the card icon 💳 . Double click on your First Citizens Rewards Card and keep it pressed until you see the copy option.

2. Enter the Wallet App, click on + and paste your First Citizens Rewards card´s information (number of cards, expiration date and verification code); or enter information manually.

3. Verify your card and you´re done! It’s that easy!

How to add My First Citizens Rewards Card to Google Pay?

Add your First Citizens Rewards card by following these 4 simple steps:

1. On your Android phone or tablet, open the Google Play Store App.

2. Press the Payment Methods Menu.

3. Under “Add Payment Method”, select the one you want to add.

4. Follow the instructions.

The new payment method will be added to your Google Account.

How to add My First Citizens Rewards Card to Samsung Pay?

Add your First Citizens Rewards Card by following these 10 simple steps:

1. Select “Samsung Pay”

2. Click on the + icon to register your card

3. Select “Add”

4. Frame the card with the camera, ensure the numbers match in the box to be automatically detected

5. Fill in the boxes with your details and click on “NEXT”

6. Read the Terms and Conditions and click on “ACCEPT ALL”

7. To verify your card, press “SMS”

8. Enter the code received via SMS to confirm. If the phone that receives the SMS is the same phone on which Samsung Pay is installed, the code will be inserted automatically. Now press “SEND”

9. Once the card is added, press “DONE” to authorize it.

10. When the bank or issuer verifies your card, you can start shopping at your favourite places.

How do I buy on Amazon with My First Citizens Rewards Card?

Make purchases using your First Citizens Rewards Card following these 3 simple steps:

1. Log-in to your account

2. Go to your Payments

3. Enter the name of the card. Add the number of the card and the expiration date. Click on add card and you´re ready!

How can I add a Credit Card to the App?

Select the “Menu” icon with the three horizontal lines. Click + and add the information of your card number, expiration date and CVV, through your camera or manually.

How can I add a Credit Card on the Web?

On top of your screen, you can click on your name and a drop-down menu will display. Click “My Account” and then go to “My wallet”. Once selected, you will find the “Menu” icon with the three horizontal lines on the left of your virtual card. Click on the card and a plus sign (+) will show; you can then add another card number.

How do I identify my favourite Credit Card?

Your preferred card is identified by a white star. In order to modify, simply press the desired card to select.

How do I delete a Credit Card?

Simply tap and hold the card you wish to delete, and drag it to the trash bin.

How do I set up my Smart Profile? Enjoy the benefits of your Smart Profile by following 3 easy steps via the First Citizens Rewards App or Web:

1. On the main menu, go to “My Account”.

2. Select “My profile”, then Edit “My profile”.

3. Proceed to edit your information or travel preferences.

What is the “flex way”?

Every time you book in App/Web with First Citizens Rewards you get unparalleled benefits – travel with peace of mind – travel the “flex way”:

- Unique and flexible fares with no extra charges for cancellations or rebooking, delayed or missing flights and baggage.

- Up to US$2 million in emergency medical services, during your trip.

- Protection for lost or damaged personal travel devices.

- Instant compensations, claims and disbursements delivered in real time.

- Best-Price Guarantee & much more!

What are Flex Rules “Flight bookings”?

Every time you book through First Citizens Rewards you get unparalleled benefits – the “flex way”:

– No fees for rebooking, cancellations, interruptions or lost connections.

– Protection for lost or damaged personal travel devices.

– Instant funds in case of delayed flights or lost baggage.

– Compensations of up to US$500 for flight and baggage delays.

– US$2M emergency medical protection during your trip.

– Best-Price Guarantee and more!

What is Best Price Guarantee?

If you find a lower qualifying rate on First Citizens Rewards or another website in your country, within 24 hours of booking your flight with us, we will credit you the price difference to your First Citizens Rewards account.

However, keep in mind that the lowest rate that you found must be available at the time of contact.

Where do I find the Terms and Conditions on the App?

Locate the airplane icon on the bottom of your screen, tap the icon and then scroll down to the end of the page. There you will find the Terms and Conditions.

Where do I find the Terms and Conditions on the Web? On the Home Page, scroll down all the way to the end and you will locate the Terms & Conditions content on the First Citizens Rewards website footer.

I just cancelled my card; can I still take advantage of the programme or use my earned miles?

Once your credit card has been closed, you will no longer be able to access these miles earned and the associated benefits of the First Citizens Rewards Programme.

Do my miles expire? Miles accumulated through the First Citizens Rewards Programme expire four (4) years after they are earned.

How can I access additional support?

Customers can send queries, not outlined in this FAQ via WhatsApp to 1-855-606-0797 for additional support.

Contactless FAQs

What is Contactless technology?

This feature allows you to simply ‘tap-and-go! The terminal and card communicate using Near Field Communication (NFC) technology which allows you to tap your card over the merchant’s point-of-sale device to make a payment instead of inserting the card.

Why use Contactless technology?

Contactless technology brings you added convenience when making payments. With just a tap, you can make quick and secure payments.

How do I use the Contactless feature on my credit card?

Once the merchant point of sale device is enabled with Contactless technology, you can tap or wave your card 2 inches over the device to make a payment.

How can I determine whether I can use Contactless at a merchant?

The Contactless icon (see below) will be displayed on the merchant’s machine.

Will Contactless transactions require a Pin?

Each transaction is assessed “individually” and you will be prompted if you’re required to enter your Pin.

Is Contactless payment secure?

Contactless uses the same secure and robust technology as Chip & PIN.

When making a payment via Contactless, your personal card information is protected.

How can I be notified of a Contactless transaction?

First Citizens offers Email Alert Service which delivers convenient, fast and secure real-time notifications. Each notification will provide you with a brief transaction description that includes the merchant’s name, the transaction status (whether approved or declined), transaction value and your real-time available card balance.

These FAQs will be of special interest to existing First Citizens credit card customers.

It is however highly recommended that all persons review the “General Frequently Asked Questions on First Citizens Credit Card with Chip and PIN technology” which provides the basic but very essential information on the change of the First Citizens suite of credit cards to “Chip and PIN” technology.

Definition: “Chip and PIN”/ “Chip and PIN technology” – refers to a First Citizens credit card that carries both the magnetic stripe technology and the Chip and PIN technology.

Existing Credit Card Customers FAQs

When will I receive my First Citizens Credit Card with Chip and PIN technology?

The conversion of credit card accounts and all credit cards on the account to Chip and PIN technology will be triggered by the earliest expiry date of any card on the account, whether it is the primary card or any additional card.

As such, you will receive your First Citizens Credit Card with Chip and PIN technology upon the renewal of the card with the earliest renewal date on the credit card account.

As per usual, the primary cardholder who is the owner of the account will be contacted in writing to collect the renewed credit card/s which will be sent to your branch of choice, as recorded on our files.

Note: VISA Platinum and VISA Signature credit cards have already been converted from magnetic stripe technology to Chip and PIN technology and so the above does not apply to these customers.

Will all cards i.e. primary and additional cards, on the credit card account be converted to Chip and PIN technology upon renewal?

Please refer to the answer to Question 1 above.

When will my new First Citizens Credit Card with Chip and PIN technology expire?

Upon renewal, each card will be renewed for 3 years.

Can I safely continue to use my First Citizens Credit Card with magnetic stripe technology until my card is renewed and converted to Chip and PIN technology?

Yes, your current First Citizens Credit Card, with magnetic stripe technology can continue to be safely used at merchants and ATMs worldwide.

Can I request that my existing magnetic stripe First Citizens Credit Card be converted to Chip and PIN technology if it is not due for renewal?

As previously noted in Question 1, the Bank’s approach to converting existing credit cards to Chip and PIN cards is based upon the earliest renewal date of a credit card on the account.

We do understand that there may be exceptional circumstances, i.e. specifically travel to Europe, and advise that if such a situation arises, you would be required to provide a written request to the Credit Card Centre, 1st Fl, 62 Independence Square, Port of Spain.

This can be done via any First Citizens branch or via the Secure Message option of the First Citizens Online Banking Service. The Credit Card Centre must receive this request two (2) weeks prior to the travel departure date.

How will the following situation be treated? : A single customer having several First Citizens credit cards, each with a different renewal date? For eg. A single customer who has a VISA Classic, a VISA Gold and a MasterCard Gold credit card?

Each credit card account will be converted to Chip and PIN technology based on the earliest renewal date on a card on the credit card account. The current magnetic stripe technology First Citizens credit card can continue to be used worldwide, where VISA and MasterCard credit cards are accepted.

How do I get my PIN for my First Citizens Credit Card with Chip and PIN technology?

The current PIN in your possession will work with your First Citizens Credit Card with Chip and PIN technology.

If you cannot remember or otherwise need a PIN please submit a written request to the Credit Card Centre, First Citizens Bank, 1st Fl, 62 Independence Square, Port of Spain or through the Secure Message option of the First Citizens Online Banking Service. The standard fee for a replacement PIN will apply.

The requested PIN will be sent to your branch of choice, as recorded on our files.

What is the importance of my PIN with my First Citizens Chip and PIN Credit Card?

Your PIN is required to process purchase transactions at chip-enabled point of sale machines as well as for cash withdrawals at chip and non-chip enabled ATMs.

Therefore your PIN has now become even a more central security element for your purchase transactions, similar to how you process LINX transactions. Whilst a sizeable number of point of sale machines in Trinidad and Tobago may be non-chip enabled, it is strongly recommended that you remember your PIN, as you never know when you will interact with a chip-enabled point of sale machine, either locally or internationally.

Your First Citizens Chip and PIN Credit Card will be blocked after three (3) inaccurate PIN attempts.

Do all the cardholders on my credit card account need an individual PIN for the First Citizens Credit Card with Chip and PIN technology?

Yes, as per usual, each cardholder receives an individual PIN, which should be known only to the cardholder. The primary cardholder can request and collect PINS on and behalf of all the cardholders on the account.

Kindly advise if PINs are required for each cardholder via a written request to the Credit Card Centre, First Citizens Bank, 1st Fl, 62 Independence Square, Port of Spain or through the Secure Message option of the First Citizens Online Banking Service.

Do I need a separate PIN to do purchases and to do cash withdrawals using my First Citizens Credit Card with Chip and PIN technology?

No, the same PIN is used in all instances, for purchases and cash advances.

Does the introduction of Chip and PIN technology on my First Citizens Credit Card affect the process of doing online purchases?

No, the process for doing online purchases remains unchanged. However, as per usual, the expiry date of the credit card is critical to a successful online purchase transaction and so, this information should be updated when you receive your renewed First Citizens Credit Card with Chip and PIN technology.

What happens to my First Citizens magnetic stripe credit card after I receive my First Citizens Credit Card with Chip and PIN technology?

For your safety, once you receive your First Citizens Chip and PIN Credit Card, you will be required to hand in your magnetic stripe card for destruction.

What are the additional fees on the First Citizens Chip and PIN Credit Card?

The sole fee which may apply is the cost of a replacement PIN if the cardholder requests same. There are no additional fees.

What will be the process if my First Citizens Credit Card with Chip and PIN technology is lost or stolen?

The current process to handle lost or stolen credit card applies. You are required to immediately report the loss via 62-FIRST (623-4778) locally or to VISA/ MasterCard if abroad at the numbers at the back of your card. Keep those numbers sate at all times.

The lost/stolen credit card will be disabled and you will be provided with a new credit card and PIN at your branch of choice. Standard charges for lost/stolen cards will apply.

Will the chargeback/ dispute process change for the cardholder in any way due to the introduction of the Chip and PIN technology on the First Citizens Credit Card?

No, the chargeback/dispute process remains unchanged.

What do I do if the chip on my credit card is damaged?

If the chip is damaged, please submit a written request for a replacement card to the Credit Card Centre, First Citizens Bank, 1st Fl, 62 Independence Square, Port of Spain or through the Secure Message option of the First Citizens Online Banking Service.

Please note though that your card will continue to work at non-chip enabled merchants, which process purchases based on the magnetic stripe rather than the chip.

Foreign Exchange Limit FAQs

What are the revised Foreign Currency limits on Credit Cards?

Why has First Citizens reduced Foreign Currency limits on Credit Cards?

The Bank continues to use its best efforts to address the foreign currency requirements of our customers and limits will be adjusted based on the availability of foreign currency. Your Credit Card continues to offer you the convenience of personal shopping both at home and abroad and access to online shopping and e-commerce. Your ability to conduct foreign currency transactions has always been and will continue to be, subject to the availability of foreign currency.

Can I request access to additional foreign currency via my Credit Card after I have fully utilized my monthly threshold?

Yes, you may request, for consideration, the ability to make additional international purchases on your Credit Card. Please submit your request via your home Branch, Commercial Officer or Corporate Banking Officer or contact Contract Centre at 62-FIRST (623-4778) or email us at easybanking@firstcitizenstt.com. Your requests will be logged and the respective representative will contact you on the status of your request.

Can I utilise my Foreign Currency Limit for the billing cycle in one transaction?

Considerations on spend are provided on a case-by-case basis and will apply to urgent transactions, particularly related to medical and educational needs. You are required to notify the Credit Card Centre to facilitate this payment. You may also be required to provide supporting documentation such as invoices. Requests are to be submitted in-person to the Credit Card Centre or via email addressed to the Contact Centre at enquiries@firstcitizenstt.com.

Can I access my Foreign Currency limit via cash withdrawals/advances at the ATM while abroad?

Yes, for your safety and convenience, you can access up to $880 US for the day which will be reset every five (5) days until your Foreign Currency limit is exhausted.

Is the foreign currency limit based on my Credit Card Limit?

Your Credit Card limit remains fully accessible in TTD currency while the foreign currency limit is in accordance with the limits outlined in Table 1 above.

Is the revised foreign currency limit a temporary measure?

The Bank reviews the foreign currency limit periodically and customers will be advised in a timely manner of any adjustments.

When will the most recent change become effective?

This change will come into effect on September 10, 2021, in keeping with the September 2021 billing cycle.

Will the foreign currency limit be further reduced?

Periodically, the Bank reviews the foreign currency limits and this may, at times, result in adjustments to customer limits.

Verified by Visa FAQs

What is Verified by Visa?

Verified by Visa is a service offered by First Citizens to our Visa credit cardholders which strengthens the security of and confidence in online shopping with your First Citizens credit card.

How does Verified by Visa work?

The Verified by Visa service strengthens the security of your First Citizens online shopping experience by capturing key data elements during your online shopping. This information is then utilized to analyse and trend customer behaviour to authenticate your online purchase.

What is the benefit of the Verified by Visa service to me?

The Verified by Visa service provides enhanced security and confidence for your online purchases. Even if your card is lost or stolen, purchases online Verified by Visa merchants would be denied approval to protect your card against potentially unauthorized transactions.

No Hassle, No inconvenience. No Enrolment – No Confirmation – No Purchase. Only Peace of Mind. And it is FREE of charge.

Is there any direct impact of the Verified by Visa service on me as a First Citizens Visa credit cardholder?

First Citizens Visa cardholders would be automatically enrolled for the service when you complete an online transaction, therefore you will no longer be prompted to register for this service before completing a purchase at online merchants who subscribe for the Verified by Visa service from their bank.

What happens when (i) my First Citizens credit card expires, or (ii) my credit card limit changes or (iii) I receive a new card after my last card was either lost, stolen or compromised?

- In situation (i) your transaction would be declined however,

- In situation (ii) and (iii) you would not be required to take any action. You can proceed with your online shopping.

What is the cost for the Verified by Visa service from First Citizens?

This service is free to all First Citizens Visa credit card customers.

Upgrade of 3D Secure Technology to 2.0

In 2014 we were the first to bring you 3D Secure Technology making online shopping safer so you are more comfortable shopping 24/7.

Now, we are upgrading the 3D Secure Technology making it simpler, faster, easier and even safer to shop online.

3D Secure 2.0 is an updated version of the original 3D Secure Technology designed to enhance customer experience and strengthen the security of online transactions.

With 3D Secure Technology 2.0 cardholders can look forward to an enhanced online shopping user experience as you will no longer be required to enrol for the service and have a password to shop online.

Cardholders are automatically enrolled and automatically authenticated when shopping online at 3D Secure Merchants.

3D Secure Technology Comparison

| 3D Secure (Old Version) | 3D Secure 2.0 (New Version) |

| 1. Cardholders must have three key pieces of information to register for the service. | 1. Enhanced customer experience as cardholders are automatically registered for the service. |

| 2. Cardholders must register for the service and create a Password and Personal Message to shop online at a 3D Secure Merchant. | 2. No password is required to shop online at a 3D Secure Merchant making the service simple, fast and easy. |

| 3. Cardholders must enter their password each time they shop online at a 3D Secure Merchant to authenticate the transaction. | 3. Cardholders are automatically authenticated when completing an online transaction through the capture of key information which is then utilized to analyse and trend customer behaviour. |

| 4. Transaction abandoned whenever cardholders are unable to remember their password. | 4. Seamless transaction as you are no longer required to remember and enter a password each time you shop online. |

| 5. Cardholders who forget their password must re-register for the service to set up a new password. | 5. No need to call the bank again for “forgotten passwords”, “incorrect password” or “account locked” messages. |

| 6. Cardholders are required to contact the bank in the event their account becomes locked after entering their password incorrectly after three times. | 6. No need to contact the bank. |

The technology is offered on First Citizens VISA and Mastercard credit cards, known as Verified by Visa and Mastercard SecureCode respectively. The service also applies to the First Citizens Prepaid Mastercard.

The Verified by Visa and Mastercard Secure Code services have been upgraded and all cardholders have been automatically enrolled for the service.

3D Secure stands for Three Domain Secure – a unique technology behind the global programs Verified by Visa and Mastercard®SecureCode™ designed to ensure safe online shopping by further authentication of the customer’s identity.

Verified by Visa and Mastercard SecureCode captures and trends key information about cardholders during your online shopping.

This information is analysed to further strengthen your online purchase with First Citizens credit cards.

First Citizens Visa and Mastercard credit and prepaid cardholders will no longer be prompted to register for either the Verified by Visa or Mastercard Secure Code Service prior to completing their purchase at online merchants who subscribe for either the Verified by Visa or Mastercard SecureCode service from their bank.

Visit our Frequently Asked Questions section for answers to all your questions.

- First Citizens VISA Customers – click here for Verified by Visa FAQs

- First Citizens Mastercard Customers – click here for Mastercard SecureCode FAQs

- One Time Passcode (OTP) Authentication – click here for One Time Passcode (OTP) FAQs

Choose to shop online with the added security and confidence that only Verified by Visa or Mastercard SecureCode from First Citizens can bring you!

Credit Card Forms

To make your First Citizens credit card experience even easier, we provide a few forms, most used by our customers, in the management of their First Citizens credit card.

To find out more and download any of the forms listed below, you may click on any of the options below:

Additional Cardholder Form

This form allows you to add that person who is most important to you to your credit card account. Follow the simple steps below:

- Print form and provide requested information.

- Sign the form where indicated (both primary and additional cardholder/s).

- Visit any branch with the completed form along with original plus a copy of the following documents. One (1) ID for the primary and each additional cardholder e.g. electoral id, passport, drivers permit. The IDs are to be certified at the branch.

Increase in Credit Card Limit Form

This form allows you to start the application process to increase your credit card limit. Follow the simple steps below:

- Print, complete and sign form where indicated.

- Visit branch with form and original plus a copy of the following documents. The documents are to be certified at the branch. – (One (1) ID e.g. electoral id, passport, drivers permit along with a salary slip not more than one (1) month old.)

- Proof of address dated within three (3) months may be required if the increase in limit results in a change in the type of credit card.

- A Personal Financial Statement (PFS) may be required if the increase in limit results in a change in the type of credit card.

Card & PIN Replacement/ Name & Address Change/ Contact Information Change Form

This form allows you to provide the Bank with all the required information to do the most common amendments required for credit cards. You may follow the simple steps below:

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

Credit Cardholder Dispute Form

This form allows you, the cardholder to query the legitimacy of any unauthorized credit card transaction posted in your credit card history.

As this process is important, we urge you to take a few minutes to familiarise yourself with some further details on the dispute process. Please click here for further details.

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

- Scan your completed forms and documents to Credit.Card_Chargebacks@firstcitizenstt.com

- Upon receipt, you would be contacted by or advised further by one of our Chargeback Officers.

Credit Card Standing Order Payment Form

This form allows you to easily make arrangements so that your credit card payments are automatically kept up to date via standing order options that suit you. Follow these simple steps:

- Print form and tick option applicable to you.

- Provide relevant requested information and documents as required.

- Sign the form where indicated.

Payments

What are my options to pay my First Citizens Credit Card?

Whether you are a student, a career builder, at the family stage or simply enjoying the finer things in life First Citizens has convenient and flexible credit card payment channels just for you.

Click on any one of the links below for further information on the payment options available to you.

Our Self Service options are:

First Citizens Online Banking

Welcome to First Citizens Online Banking.

- Manage your accounts, Pay your credit card

- Open accounts, Apply for loans and credit cards

- Pay bills and transfer funds to friends and family

Get started today sign up now…

First Citizens Online Banking

First Citizens Online Banking … enjoy the ease and accessibility of the simplest yet most powerful money management tool available to you.

This absolutely FREE service, allows you to do your routine banking and non-banking transactions at your whim and fancy!

Available 24/7, all you need to move to the ultimate in Self Service Banking is internet access. Further details on system requirements can be found at FAQs – Security.

No other service affords you the widest variety of transactions and benefits as the First Citizens Online Banking Service:

- View your First Citizens account and credit card balances and transaction history anytime. No need to wait on statements!

- Access a Secure and Convenient online channel to send your requests for service and assistance, through the Online Banking Secure Messaging Facility!

- Transfer funds quickly between your First Citizens accounts OR to anyone else at First Citizens or any other local bank!

- Pay your First Citizens and other banks’ credit card bills easily!

- Make payments to over 30 institutions, including other Banks, Financial Institutions and merchants! Save time!

- Open an account or apply for a loan online. So fast and easy!

- Stay informed. When you’re on the go, receive account alerts via e-mails.

- Online Wire Transfer Request Form

- Ability to pay multiple payees in a single transaction.

- Ability to re-order cheque books.

- Ability to download account information to Microsoft Excel, Quicken and Money formats.

- Transfers from your Abercrombie fund.

All these transactions are done in a highly secure environment that encrypts your information as you transact. In addition, you are well covered by a host of security measures such as secret questions and transaction pins. Click for more details.

Customer Support for Online Banking Customers is just as convenient as the service itself:

1. Call our Contact Centre at 62-FIRST Option 3 (623-4778 Option 3)

2. Log in to the Online Banking Service, once possible, and send a Secure Message OR

3. Send an email to channelsupport@firstcitizenstt.com OR

4. Our Web Chat option

Interested in Online Banking?

Do not hesitate….register or start using the service NOW to reap the fruits of more time and a more relaxed frame of mind.

If you like our Online Banking Service, we encourage you to also check out our: Mobile Banking and Telebanking Services too. These services offer many similar benefits and you never know when you may need them most!

First Citizens Telebanking

The First Citizens Telebanking Service brings convenience to your fingertips….saving you precious time and money.

This simple Self Service Telebanking service is available 24 / 7 to anyone with access to a landline or cellular phone and allows you to do your most routine banking transactions whenever you want to!

Take advantage of the many benefits you can easily access from this FREE service!:

- Access to information at your fingertips!

Listen to your First Citizens account/credit card balances and transaction history anytime! Obtain information on your savings, chequing, some investment, loan and credit card accounts!

- Flexibility when you need it most!

Transfer funds quickly between your First Citizens accounts! Authorise cheque stop payments!

- Manage your First Citizens credit cards!

Access your outstanding and available balances, your minimum or full payment amounts required plus pay your credit card when you want to, 24/7!

- Convenient payment method for your vital needs, 24/ 7!

Pay your WASA, TSTT, TTEC and your First Citizens credit card bills at your convenience!

So how do you access all these great benefits of the First Citizens Telebanking Service?

1. Register for the Service.

2. After registration, you can access the Service by calling 62-FIRST (623-4778) and selecting Option 1 for the Self Service Option

3. Enter your Customer Identification Number (CIF) and your Personal Identification Number (PIN), assigned during the registration process.

4. Proceed to select the transaction of your choice, as stated to you by the system.

What are the requirements and how do I register for the First Citizens Telebanking Service?

1. Firstly, you should own a First Citizens account, either a savings, chequing, investment, loan or

credit card account.

2. Then, you can visit any of our conveniently located branches throughout Trinidad and Tobago OR

3. You can begin the process by submitting your contact information and we can then assist with your branch appointment to complete the process.

How secure is this Service?

This is a PIN based service, which simply means that the only way information can be accessed is if someone knows your PIN. Your PIN is selected during the registration process but can also be changed anytime after registration through a secure process. As with any other PIN based service, you determine how secure it is by the safeguarding of your PIN; no one should know your PIN except you!

Tips for Using the First Citizens Telebanking Service:

1. Bill payments should be made at least five business days before the actual due date of the bill.

2. Monitor your accounts regularly by listening to recent transactions. Query suspicious activity as soon as you detect it.

3. Contact our Contact Centre Staff using 62-FIRST (623-4778) Option 3 if you have any queries.

Customer Support for TeleBanking Customers is just as convenient as the service itself:

1. Call our Contact Centre at 62-FIRST Option 3 (623-4778 Option 3)

2. Log in to the Online Banking Service, if registered for this service and send a Secure Message OR

3. Send an email to channelsupport@firstcitizenstt.com OR

4. CLICK TO CHAT our Web Chat Option

Interested in the First Citizens Telebanking Service? Do not hesitate….register or start using the service NOW to reap the fruits of more time and a more relaxed frame of mind.

If you like our Telebanking Service, we encourage you to also check out our: Mobile Banking and Online Banking Services too. These service offer many similar benefits and you never know when you may need it most!

First Citizens ATM network

Utilise our convenient network of 52 Onsite and 67 Offsite ATM Locations within Trinidad and Tobago.

Features :

- Withdraw cash from your First Citizens deposit accounts

- Make deposits to your First Citizens deposit accounts

- Transfer funds between your First Citizens deposit accounts

- Make balance inquiries of your First Citizens accounts

- Pay TSTT, T&TEC and WASA Bills

- Do Credit Card cash advances

- Register for UTU Mobile Top Up Service (at Branch ATMs)

- Accepts LINX debit cards

Tips for using ATMs

- Memorise your PIN, and never disclose it to anyone, including Bank Staff

- Change your PIN if you suspect it has been compromised

- While using the ATM, protect your privacy

- Stay alert, take stock of your surroundings while using ATMs

- Before leaving the ATM put away your card and cash properly

- If your card is lost or stolen report it immediately using 62-FIRST (623-4778)

- Report suspicious activity when detected

Emergency Card Replacement Service

Through the Visa Consumer Benefit Services Center, Visa provides emergency services 24 hours a day to Visa cardholders worldwide. Cardholders can call the network of collect-call telephone numbers and request emergency services related to their Visa cards.

The emergency card replacement service provides the cardholder with an emergency Visa card replacement while the cardholder is at their home country or traveling abroad.

Access full details on this benefit, as well as certificates and processing of claims at the Visa Benefits Portal at www.visa.com/benefitsportal.

The use of First Citizens Cards to conduct face to face or non-face to face transaction at the countries listed below is strictly prohibited. As such, these transactions would be declined.

The United States Office of Foreign Assets Control (OFAC) has put in place specific sanctions against the following countries:

| Afghanistan | Balkans* | Belarus | Burma (Myanmar) | Central African Republic | Cuba |

| Ethiopia | Hong Kong | Iraq | Lebanon | Libya | Mali |

| Nicaragua | Somalia | South Sudan | Sudan & Darfur | Syria | Ukraine |

| Venezuela | Yemen | Zimbabwe | Democratic Republic of Congo |

*OFAC sanctions are specific to the Western Balkans region which is comprised of the following countries:

| Albania | Bosnia and Herzegovina | Kosovo |

| Montenegro | Serbia | Former Yugoslav Republic of Macedonia |

Card at a glance

- This Credit Card offers: Great travel rewards

- Annual Fee: TT$300

- Credit Line: Starting from TT$10,000

- Interest Rate: 2% per month

Features

- Rewards: Airline tickets, hotels, car rentals, tourist activities

- Points Value: 1 point for every TT$8.50 spent

- Points Limit: 80,000 points per year

- Points Expire: Four years after earned

- Card Benefits